Fast processing times, a robust online administration system, and highly scalable capacity are just a few reasons hundreds of companies rely on Checkissuing’s award-winning check printing services. Our secure platform allows businesses to print checks online and manage end-to-end check distribution through a centralized system designed for accuracy, control, and volume.

In addition to powerful check printing software and check writing software, Checkissuing offers a modern API and advanced USPS services, including NCOA® (National Change of Address), CASS™ (Coding Accuracy Support System), and Intelligent Mail® barcode tracking. These features help ensure checks are delivered accurately, tracked reliably, and handled by one of the most trusted check printing companies in the industry.

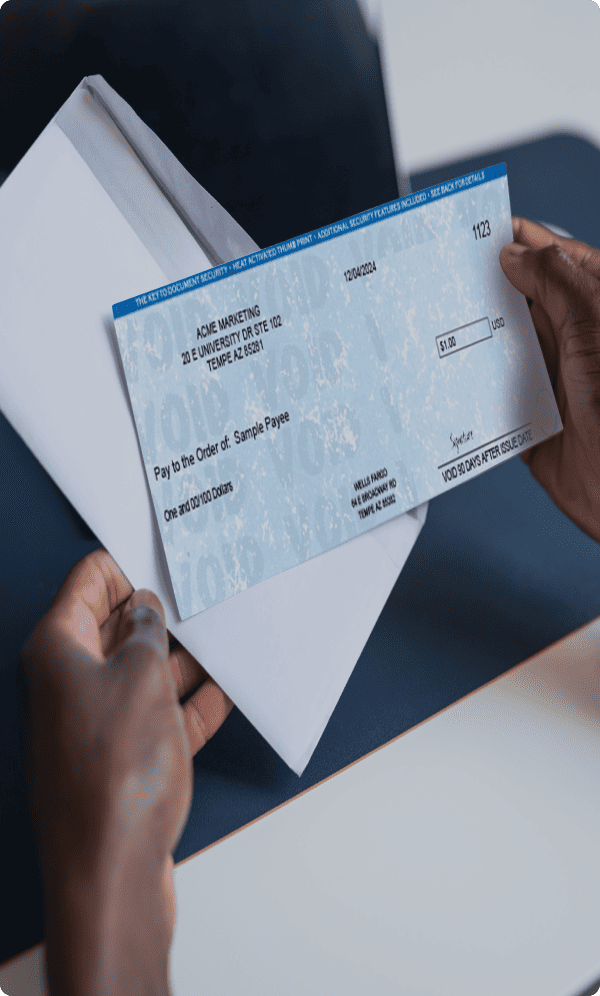

High-Security Checks

With CheckIssuing’s outsourced check printing and mailing services, businesses gain enterprise-grade protection without managing physical check stock in-house. Our secure online check writing software combines certified printing partners with advanced fraud-prevention features, allowing companies to confidently print checks online at scale.

Please see a sample of one of our checks here

High-Security Envelopes

All envelopes used in our outsourced check printing services include black security tint, preventing sensitive payment information from being read through the envelope. These envelopes are designed to support high-volume online check mailing services while reducing exposure to mail theft and fraud.

All Outsourced Check Printing Services include Document Integrity.

Online Check Printing And Online Check Mailing With First-Class Mail Tracking

Automated Check Printing Services, Including Robust Mailing Options

Our online check printing and mailing administration system and API allow businesses to securely upload, process, and automatically issue bulk or single check payments. Users can access reports, manage permissions, and control workflows instantly from a mobile device, desktop, or tablet — all through one centralized check printing software platform.

From invoice processing and approval to payment scheduling and reporting, our online check printing software dashboard enables teams to issue thousands of checks with just a few clicks. Payments are released using your preferred delivery methods without requiring access to multiple portals. As a trusted check printing company, we design our platform to protect client interests while supporting related payment services that scale with your operation.

Upload CSV files securely through our EV-SSL 128-bit encrypted administration system or submit data automatically via our modern API. These secure workflows are validated through our SOC audit, ensuring sensitive financial information stays protected while recipients receive their mailed checks accurately and on time.

Our check printing services use Magnetic Ink Character Recognition (MICR) technology — a banking-standard security method that relies on specialized ink and character formatting to reduce fraud risk. MICR ink allows checks to be scanned and processed quickly and accurately throughout the banking network, while also increasing resistance to alteration or duplication.

As part of our bulk online check printing and mailing software systems, MICR technology adds an essential layer of protection that supports faster clearing and greater trust from financial institutions. This combination of secure materials and modern check printing software helps businesses print checks online with confidence, even at high volumes.

For businesses new to online check printing and mailing, security is often the first concern. Positive Pay is a bank-level fraud prevention process designed to protect against unauthorized or altered checks by coordinating directly with the issuing bank.

With Positive Pay, issued check details — including check number, issue date, and amount — are securely transmitted to the bank. When a check is presented for payment, the bank automatically compares it against the approved file. If any discrepancies are found, the item is flagged as an exception for review before funds are released. This process significantly reduces fraud risk and makes modern check writing software one of the safest ways to issue payments at scale.

Positive Pay helps prevent:

Whether your organization sends ten checks or 100,000 checks, Positive Pay adds a powerful layer of protection to your check printing services without adding operational complexity.

As part of our offering, CheckIssuing provides a flexible Positive Pay workflow. Clients can supply their bank’s Positive Pay format, and our system will automatically generate the required files. These files can be uploaded directly to the bank or made available for secure download through our check writing software dashboard. When outsourcing check printing and mailing services, Positive Pay transforms check issuance into a controlled, auditable, and highly secure process.

Online check mailing does not have to feel generic. As part of our outsourced check printing and check writing services, CheckIssuing offers flexible customization options that allow businesses to maintain branding and professionalism across every payment they send.

Our advanced check printing software supports colored or black-and-white logos, branded documents, and optional marketing inserts included directly with mailed checks. These options help businesses reinforce brand identity while continuing to print checks online securely and at scale.

Available customization options include:

All customization options are offered at competitive pricing and processed through our secure check printing systems. CheckIssuing is a check printing company built to give clients flexibility without sacrificing speed or security.

Our online check printing and check writing software supports multiple bank accounts under a single primary login, making it easy to manage complex payment structures without added administrative overhead. Businesses can issue checks from different funding sources by specifying the bank alias directly within a CSV file or through our API.

This structure is especially valuable when outsourcing check printing and mailing services for multiple departments, business units, or clients. Each account can use its own customized check template, ensuring consistency in branding while maintaining full control over funding sources.

When recipients receive their checks by mail, the final product reflects exactly how you want it to appear — accurate, branded, and professional.

To simplify onboarding and security, CheckIssuing partners with Plaid to offer instant bank account authorization. Our check printing software also supports Plaid token exchange for seamless and automated system integration, reducing setup time while keeping financial data protected.

Automated Cashed Check Status Updates

With most U.S. banks, our check printing software can identify when checks have been deposited and automatically update their status. These updates are visible in real time through our online administration system or API, reducing follow-ups and reconciliation delays.

Workflow Management

Set up approval workflows directly within the check writing software by defining approval tiers based on payable ranges. This ensures consistent controls and prevents unauthorized payments while maintaining operational speed.

Check Images & Archiving

View or download images of issued checks at any time through the platform. Users can also export check images in bulk as ZIP files for selected date ranges, simplifying audits and recordkeeping.

User Management & Security Controls

Create unlimited users with customized permission levels. Two-factor authentication (2FA) is available to support a highly secure online check printing process.

Bundling & Mailing Optimization

Group enveloped or non-enveloped checks into USPS or FedEx packages for delivery to a single service address, reducing postage costs and streamlining bulk mail handling.

Signature Options

Our check writing software supports multiple signature options, including uploaded signature files, digitally generated signatures, or signatures created using a mouse, finger, or stencil. Flexibility ensures compliance without slowing production.

Check Number Control

Upload preferred check numbers with each payment or allow the system to automatically assign sequential numbers for accuracy and consistency.

Recurring or Future Payments

Schedule checks to be issued on recurring intervals or future dates, allowing businesses to automate predictable disbursements while continuing to print checks online with full control.

Payee Management System

Save payee details securely within the platform to issue on-the-fly checks as needed, eliminating repetitive data entry and reducing errors.

CheckIssuing is a check printing company built around security, reliability, and modern automation. We consistently adopt the latest security standards and technological innovations to ensure our clients can print checks online with confidence.

Our bulk online check writing software and automated check printing solutions have been used dependably for many years by hundreds of small, mid-sized, and enterprise organizations that outsource their check printing services. The result is a stable, scalable payment workflow that supports high volume without sacrificing control, visibility, or security.

Check writing and mailing services allow businesses to generate, print, and mail checks securely through a professional platform – eliminating manual printing, stuffing, and mailing processes. These services support bulk and individual payments with real-time tracking and USPS/expedited delivery options.

You upload payment data via CSV or API. The system formats and prints the checks, inserts them into envelopes, and mails them through USPS or carriers like FedEx/UPS. Real-time tracking and mail verification help ensure delivery accuracy.

Yes – CheckIssuing lets you upload or integrate payment details online, then it securely prints and mails checks on your behalf, with optional same-day mailing.

Checks can be mailed via USPS First-Class Mail (standard), USPS Priority, USPS Priority Express, and expedited carriers such as FedEx (overnight and 2-day).

CheckIssuing uses enterprise-grade security including encrypted administration systems, MICR printing technology, watermarked high-security checks, advanced USPS services (CASS®, NCOA®), and Positive Pay fraud detection.

Positive Pay is a bank-level fraud prevention process that matches check data against a bank file to flag unauthorized or altered checks, reducing the risk of check fraud.

While magnetic ink was historically required, modern check processing captures images electronically. However, CheckIssuing still uses MICR technology for faster processing and added security.

Yes – you can customize check and envelope designs with logos, branded elements, and optional marketing inserts such as flyers or newsletters.

Tracked mailing options like USPS Priority, Priority Express, Certified Mail, and courier services include tracking capabilities so you can see delivery progress.

Banks typically verify a check’s legitimacy by confirming available funds, matching payee information, or contacting the issuer directly.

Yes – checks can be mailed internationally, as long as the address adheres to international conventions and complies with regulatory requirements.

Improper formatting can result in delayed or returned mail. CheckIssuing uses geocoding and verification checks to improve accuracy, but follow-up may be needed for unusual address formats.

For check payments, the minimum is $0.01 and the maximum is typically dictated by your bank’s limits.

You can upload payment data via CSV or integrate through APIs for automated workflows. CheckIssuing works with accounting and ERP systems like QuickBooks, and role-based permissions let you control who in your organization can create or release checks.

There are no monthly fees or minimums-you only pay for the services you use. Checks submitted before the cutoff are typically mailed the same business day. Support and onboarding assistance are available directly through the website.

Ready to Simplify Check Writing and Mailing?

If your team is still managing check printing, signing, and mailing in-house, small delays and manual steps can quietly add up. CheckIssuing helps you automate check writing and mailing so payments go out accurately, on time, and without added administrative burden.

Contact us today to discuss your payment volume, workflows, and how outsourced check writing and mailing can support a more reliable accounts payable process.