Checkissuing.com is here to help you make completing your 1099-NEC easier than it’s ever been before! Our 1099 tax form services are discreet and confidential. You can rest assured that we will always file your miscellaneous income form correctly. The definition of miscellaneous files for the 1099 tax form is always subject to change, and it’s essential to report your miscellaneous income accurately to fulfill your tax responsibilities each year. Here’s what you need to know about this tax form and how we can assist you.

About Checkissuing’s Services

Checkissuing.com works with every client to develop a range of services tailored to your business needs. We have a team of seasoned tax professionals that can assist you with all of your 1099, 1098, and 1096 filing and reporting requirements. We have robust technology and dedicated, knowledgeable professionals to help you every step of the way, and a direct corrections portal linked to the IRS’s database. After filing your taxes and receiving your corrections, you can log directly into the online portal to make changes and resubmit your tax forms. Here’s a quick look at what you need to know about Form 1099-MISC.

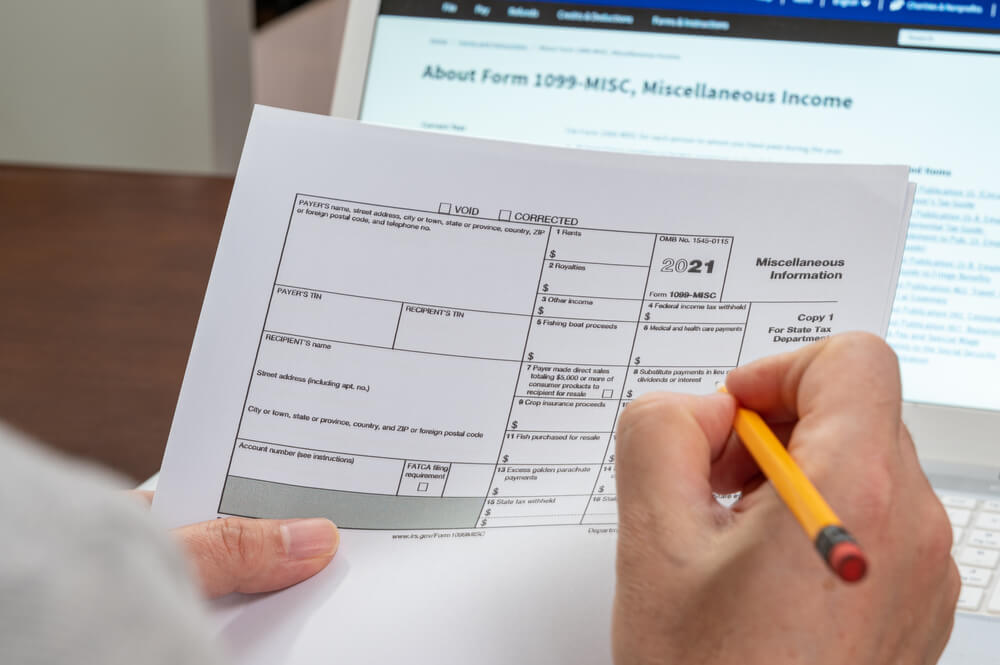

What Information is on the 1099 Tax Form?

What is a 1099 MISC? Form 1099-MISC is a standard Internal Revenue Service (IRS) form used to report certain types of miscellaneous compensation. The misc files definition includes income such as rents, prizes, and awards. In years past, Form 1099-MISC was also used to report non-employee compensation for independent contractors, freelancers, and the self-employed, serving as a document for non-employee compensation.

In the year 2001, the IRS estimated that over 16% of taxes owed weren’t paid on time. The new form is designed to streamline reporting requirements and help close the estimated $345 billion tax gap resulting from late payments.[1] Starting with the 2020 tax year, non-employee compensation is reported to the IRS using Form 1099-NEC: Nonemployee Compensation. These forms are typically used to report business payments, rather than personal ones.

Who Needs to File a 1099-MISC: Miscellaneous Income Form?

Form 1099-MISC is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest to another person. The form is also sent to each person to whom you paid at least $600 during the tax year in any of the following categories:

- Rents

- Cash Prizes and financial awards

- Payments to an attorney

- Other cash income

If you have any questions about whether the income should be reported as 1099-MISC or NEC income, you can review the IRS website or contact us. Our knowledgeable team has helped many businesses throughout the years with filling their tax forms, so we can answer any questions you may have.

Other Forms Which Might Also Be Required

In addition to your 1099-MISC and NEC Forms, the following forms might also be required for certain types of businesses:[2]

- 1099-INT for interest payments to individuals and specified private activity bond interest and federal income tax withheld, if applicable.

- 1099-B for proceeds from Broker and Barter Exchange Transactions.

- 1099-C for each debtor for whom a debt owed is $600 or more if the debtor is an individual, corporation, partnership, trust, estate, association, or company.

- 1099-R for Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- Form 1099-S for a sale or exchange transaction of money for indebtedness, services, or property of ownership interest.

- 1098 for mortgage interest of $600 or more received during the year from a trade, business, or an individual, including a sole proprietor.

- Form 1098-MA for homeowners and mortgage assistance payments.

How to File Form 1099-MISC: Miscellaneous Income With the IRS

When you’re one of our clients at Checkissuing, you’ll be able to access all of your 1099, 1098, and 1096 tax records through our secure and easy-to-use portal. The portal connects to your CRM system, and you can upload all of your own forms and information from a CSV file. Our portal will automatically add the information to your reporting, enabling you to track your account in real-time and make changes.

Our portal will enable you to view and create forms, provide proofs for client review and approval, and handle all printing and mailing responsibilities. Our team of professionals subjects all records to independent quality control review, and any forms that aren’t submitted electronically will be mailed securely. Our envelopes are stamped with “Important Tax Information Inside” to ensure they reach the appropriate departments on time. You will receive a confirmation when the IRS accepts your forms.

Checkissuing Provides Custom Solutions for Your Business

Checkissuing.com is here to streamline all of your check mailing and document mailing needs through our portal. There is no software to purchase, install, and learn. We will set you up on our portal quickly and easily, and make sure that you’re properly trained on its use.

Our services include data conversion, printing, mailing, and e-filing services at competitive pricing. We’re a large volume operation, enabling us to keep our rates among the lowest in the industry. If you can find a lower price for similar services, we will match or beat it.

Our team of professionals and tax experts utilizes a robust web-based system that seamlessly integrates with the IRS, ensuring the just-in-time delivery of all your payments and filings. You’ll meet every deadline, remain compliant with all current IRS and state government tax filing regulations, and reduce your administrative costs. We’re registered with the IRS FIRE (Filing Information Returns Electronically) program designed to take the guesswork out of your filing, and we will always answer as many questions as you have.

Automation is what we excel at, and we love finding ways to help our clients reduce paper waste and increase efficiency. We can help you automatically print and mail statements to your customers and vendors and file your tax forms with the IRS. Our services help you automate routine tasks so that you can be free to focus on your daily business operations without having to worry about meeting your tax filing and reporting responsibilities. Contact us today for more information, and let us know how we can help you with your tax forms and 1099 reporting!

Last updated: September 2025