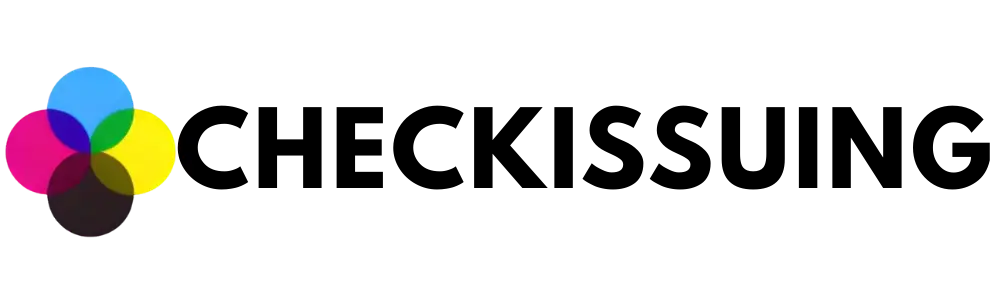

What Growing Companies Overlook in Rebate Management

Rebate management is one of the most effective — and flexible — tools growing companies can use to drive sales. At their core, rebates are simple: customers pay full price and receive a refund later. That refund can come as a check, prepaid card, digital payment, or even instant savings at checkout. For companies looking […]

Send eCheck Online Instantly: When Speed Matters for Business Payments

Speed in business finance is not just about convenience. It can protect margins, prevent late fees, and keep operations moving when timing is tight. The uncomfortable question is simple: What happens when a payment is stuck, but the work cannot wait? When you can send an eCheck online instantly, you get a modern way to […]

Check Printing Software vs Check Writing Software: What’s the Difference for Businesses

Most businesses still issue checks, even as other payment rails grow. That choice can quietly shape your fraud exposure, your AP workload, and your ability to scale. The confusion is understandable: check printing and check writing software sound the same, and they often appear in the same conversation. They are not the same. Once you […]

The Real Cost of Filing 1099s Incorrectly: Penalties, Fees, and Fixes

Most teams think of 1099s as quick year-end paperwork, right up until a small mistake turns into penalty letters and surprise administrative cleanup. The IRS tightened its rules in recent years, including the shift to mandatory electronic filing once a business hits ten information returns. Even tiny inaccuracies travel far once they enter that system. […]

How Lockbox Services Reduce Days Sales Outstanding (DSO)

Lockbox services sit at an interesting crossroads in finance. DSO keeps rising across many organizations, and check payments, though shrinking, still account for about 26% of B2B transactions. That mix creates delays that companies can feel in their cash flow. Slow mailrooms, inconsistent deposit routines, and scattered remittance data all drag the payment cycle. Modern […]

How Electronic Checks Support More Predictable Cash Flow

Cash flow often feels unpredictable for a simple reason: Payment timing is inconsistent. A payment can be approved on time but still land late due to handoffs, corrections, or delivery variances. That gap makes forecasting feel like guesswork, especially across distributed teams. For accounts payable, the goal is not perfection. It is repeatable execution, so […]

How Vendor Classification Errors Create Long-Term 1099 Tax Compliance Risk

Vendor classification errors usually show up as a rushed vendor setup, a missing tax form, or a payment coded “close enough.” But when you scale that across months, the tax compliance risk builds quietly. In the current era of 1099 electronic filing, systems are less forgiving, and mismatches surface more quickly. This article breaks down […]

How Incomplete Vendor Data Creates Downstream 1099 Compliance Risk

Most vendor data issues start quietly: an incomplete W-9, a missing TIN, or an address that never gets updated. The trouble appears months later, when inconsistent workflows across teams turn those gaps into real 1099 exposure. As more organizations rely on 1099 filing online, the room for manual fixes shrinks. This article walks through how […]

How Digital Checks Improve Payment Consistency Across Distributed Teams

Distributed teams make even simple payment routines feel unpredictable. Approvals move at different speeds, vendor details drift, and mailed checks introduce delays that no one can easily track. The challenge is more pressing because checks remain widely used in business payments. Federal Reserve research in 2024 notes that 73% of U.S. businesses still rely on […]

Why Lockbox Services Reduce Payment Processing Errors

Manual accounts receivable work tends to fail in the same places: the moment checks and remittance get separated, the moment someone must rekey a reference number, and the moment a payment does not match cleanly to an invoice. Those small slips turn into real operational drag, including misapplied cash, delayed posting, and reconciliation that takes […]