You may have heard of MICR in reference to checks. However, you might still be wondering, what does MICR mean? The Magnetic Ink Character Recognition line, commonly referred to as the MICR line, is a piece of ink-based technology used to prevent check fraud. It is used in a variety of ways but ultimately is one of many factors that help expedite the time it takes for a check to be verified by banking institutions and clear an individual’s bank account.

Below, we answer and outline some common questions and concerns individuals have in regard to magnetic ink character recognition and how it works.

What Is Magnetic Ink, and How Does It Work?

If you are unfamiliar with the technology utilized to print authentic checks, you may not be familiar with magnetic ink. Magnetic ink, simply put, is ink that contains magnetic properties. The ink, therefore, reacts to magnetic fields. This magnetic ink or toner is used to print the checking account information that typically appears on the bottom of checks in block-style numbers.

In order to verify the legitimacy of the check, the check must have the MICR line. Banking institutions will pass the check through a magnetic field, and the ink will respond. Much like technology that was used in floppy disks, the magnetic particles in the ink hold information that can then be read and verified by the banking computer system. Once the banking system is able to verify the validity of the check through the bank’s network, the check is able to clear automatically.

What Is MICR Used For?

Another common question that individuals have in regard to this technology is why it is used. Ultimately, it’s used to prevent check fraud. Much like how money is produced, banking officials have had to find ways to verify and ensure the validity of checking documents due to potential fraud.

Frequently, checks will be flagged for fraud by a banking institution due to issues with the MICR line. In some cases, these lines are missing or invalid. Checks will be flagged if, when they are run through the magnetic field, they are unable to register the magnetic ink line or receive information that is incorrect. Though many individuals believe that this line only displays banking information, it is yet another way for banks to confirm that a check was legitimately printed.

What Are the Benefits of Banks Using MICR?

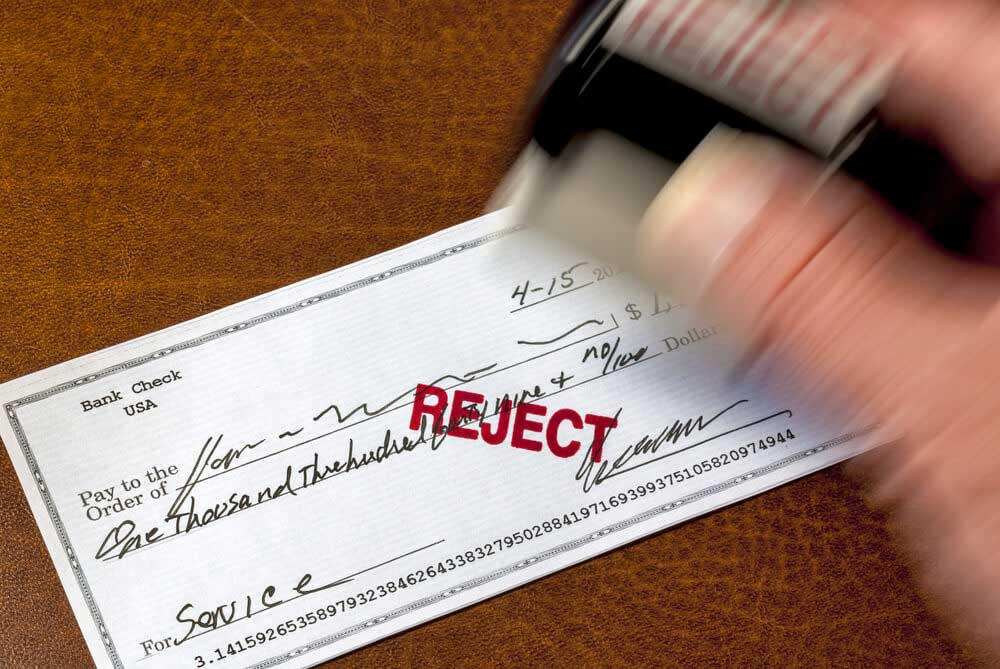

Checking institutions are required to print their checks using magnetic ink character recognition as per the Federal Reserve. Checks that do not include the MICR line are likely to be rejected by banking institutions, which can result in additional processing fees and require the check to be reissued. Furthermore, banks and individuals that do not confirm the information included on the magnetic ink line can face legal trouble, including potential fraud charges.

The biggest benefit individuals receive from the utilization of magnetic ink character recognition is a reduction in fraud. Scammers will often steal banking information and attempt to print and cash a check in the name of the individual whose information they have stolen. If they do not have legitimate checks or have simply scanned and altered a check, it will not be recognized by the banking system and will be rejected.

This saves many account holders from what could result in hundreds, if not thousands of dollars of fraud. Without the ability to verify the legitimacy of a check, fraud victims would not be able to prove that they did not write or cash a check, putting their finances at risk.

Do All Banks Use Magnetic Ink Character Recognition Lines?

Banks within the United States are required to use the MICR line as it helps streamline the verification process and makes it more simplistic. However, the practice has spread globally and is used in the United Kingdom, Australia, Canada, and South America. It’s additionally used in many Asian countries.

Typically, issues with foreign checks and magnetic ink lines aren’t common. This is due to the fact many direct checks are not cashed outside of their country of origin. When they are, they are often required to go through additional verification processes to be determined as legitimate.

Can Magnetic Ink Character Recognition Cause a Legitimate Check to Be Rejected?

Yes, legitimate checks with legitimate MICR lines can be rejected by banking institutions. Typically, if an account has been flagged for fraudulent activity in the past, the check can be flagged. Moreover, individuals who have a history of writing hot checks may also have their accounts flagged.

When the banking institution scans the check through the magnetic ink readers, the information that is stored and then transferred through the magnetic properties of the ink will refuse the check. At this point in time, the check issuer will need to reach out to their banking institution to determine the precise problem and, potentially, have the flag removed.

What Happens If Your Check Doesn’t Have an MICR Line?

If you receive a check that does not have an MICR line or one that has an invalid magnetic ink line, it likely is not a legitimate check. In many cases, individuals who attempt to create fraudulent checks will simply photocopy a check on checking papers. While the check may look and feel legitimate, if the information included on the magnetic ink character recognition line is invalid, the check may not be able to be authenticated.

Naturally, if you have concerns about the validity of a check you received, you can take it to your local bank and ask for assistance. They will be able to review the check and open an investigation should they have issues confirming its validity. They will also be able to provide you resources in the event you receive a potentially fraudulent check.

Magnetic ink character recognition has been utilized since the 1950s in the United States and throughout much of the world. It is one of the best ways for retail stores, banks, and even individuals to ensure they are not the victim of check fraud. If a check is written and rejected due to issues with the magnetic ink line, the individual will need to contact their bank for further information on how to resolve the issue.

Ultimately, this technology is used to ensure that potential scam artists cannot simply photocopy and mass-produce illegitimate checks. The information transferred through the magnetic ink is able to confirm if the check was legitimately issued by the banking institution listed and if the account the individual is attempting to withdraw funds from is a valid account.

While this does not resolve all forms of check fraud, as individuals attempting to pay by check at a store still have the ability to write a hot check, it does ensure scammers have a much more difficult time creating and distributing illegitimate checks. If you notice that prior to cashing a check it does not have a magnetic ink character recognition line, confirm with the banking institution that the check is legitimate. For further information about how MICR can be used to help keep you and your payees safe and check fraud prevention, contact us at Checkissuing.com.