What to Know Before You Send eChecks (Digital Check) Online Instantly

Mailing paper checks used to be the standard operating procedure for businesses. Print the check, sign it, place it in an envelope, apply postage, and wait for delivery. While that system worked for decades, it is no longer efficient for companies that need speed, security, and cost control. Today, businesses can send eChecks (digital checks) […]

When eChecks Are the Right Alternative to Mailed Checks

Paper checks aren’t complicated. But they are manual. They require printing, signing, stuffing, stamping, mailing, reconciling, researching lost payments, and occasionally reissuing checks. None of those steps feels dramatic in isolation. Together, they consume time, budget, and operational focus. eChecks aren’t about eliminating paper entirely. They’re about recognizing when paper is adding friction that simply […]

Check Printing Software vs Check Writing Software: What’s the Difference for Businesses

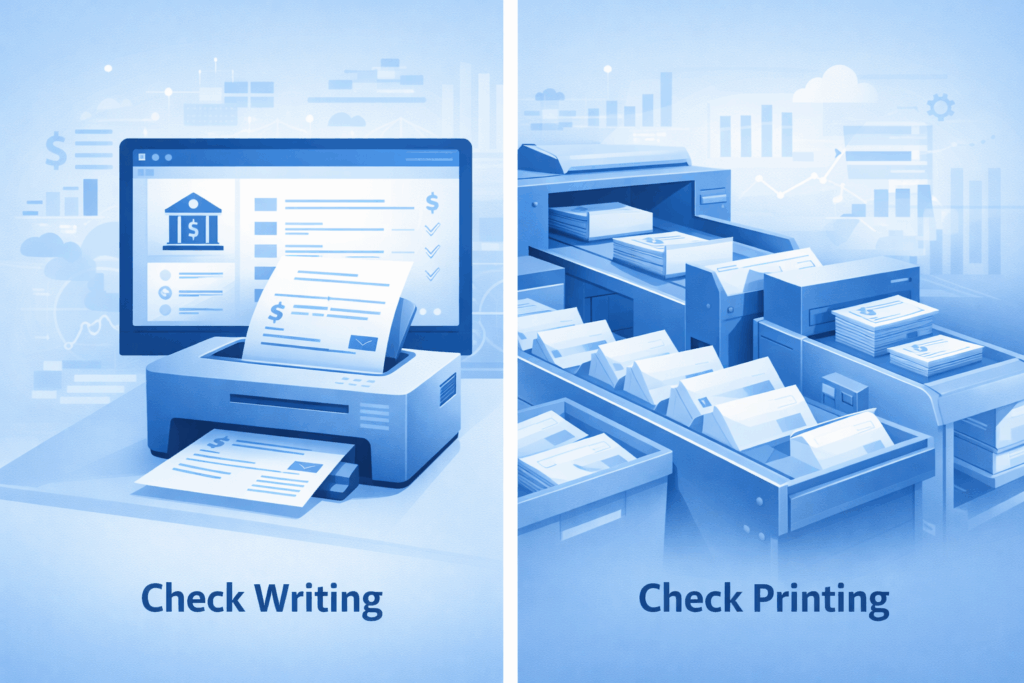

Most businesses still issue checks, even as other payment rails grow. That choice can quietly shape your fraud exposure, your AP workload, and your ability to scale. The confusion is understandable: check printing and check writing software sound the same, and they often appear in the same conversation. They are not the same. Once you […]

How Digital Checks Streamline Vendor Payments Across Multiple Locations

Paying vendors is rarely the hard part. Paying them consistently when work happens across offices, job sites, and remote teams is where things get messy. Paper checks introduce extra handoffs, mail delays, and blind spots the moment a payment leaves the building. A digital check approach (often grouped under eChecks) tightens that whole loop. It […]

How Lockbox Services Cut A/R Processing Time in Half

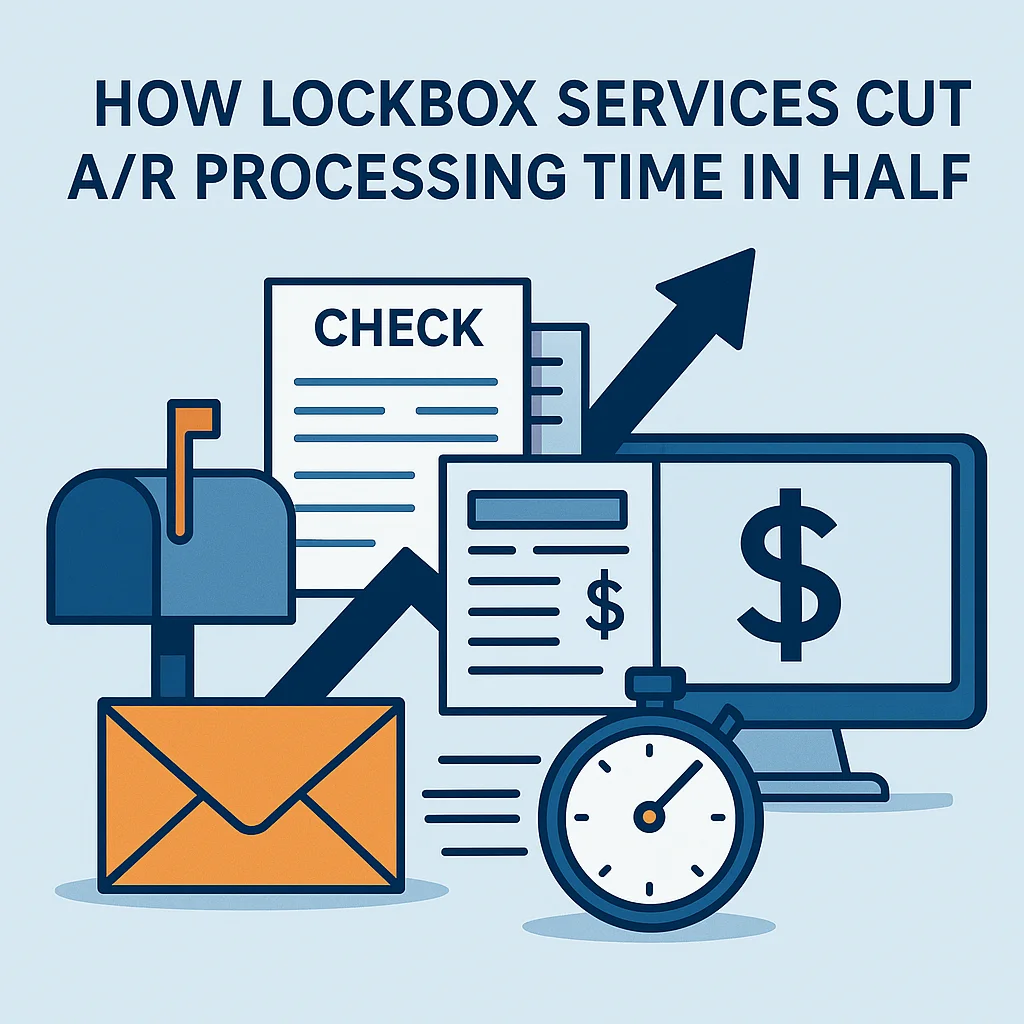

The pace of B2B payments keeps shifting, yet one thing hasn’t changed: Checks still slow down accounts receivable (A/R) teams far more than expected. Mail float, manual sorting, and basic data entry add days to the cash cycle. Rising check-fraud attempts make the process even riskier. Lockbox services centralize incoming payments, digitize check data, and […]

How Check Fraud Evolved — and Why Manual Controls Aren’t Enough

Check fraud has picked up speed in ways that catch many finance teams off guard. Criminal groups now combine chemical alteration, digital replication, and stolen mail to create items that look legitimate long enough to clear. That pattern matters because high-value vendor payments still run through paper checks, even as the rail itself becomes easier […]

Instant Checks: What They Are and When to Use Them

In business, timing is everything. Payroll that misses a cutoff, a vendor waiting for payment, or a reimbursement that can’t wait until morning are some of the moments that test how quickly a company can respond and how well it protects its people and reputation. Instant checks are not a shortcut but real, physical checks […]

Bulk Check Printing: Why High-Volume Businesses Should Automate Payouts

For all the talk about going digital, paper checks refuse to disappear. The Federal Reserve still reports that in 2023, banks processed roughly $33.8 billion in check payments every day. Stretch that over a year, and you’re looking at trillions of dollars still moving by paper. It’s hard to call that obsolete. If you manage […]

How to Spot Hidden Fees in Online Check Printing Services

It’s easy to get drawn in by a low headline price. You see “25¢ per check” and think, “That’s it? Perfect.” But if you’ve ever handled accounts payable, you already know things are rarely that simple. The final invoice almost always tells a different story. Many check printing services structure their pricing to look clean […]

Top Red Flags That a Check Might Be Fake (and How to Spot Them)

Fraud isn’t always dramatic. Sometimes it’s a piece of paper or a PDF in your inbox that looks routine. In 2024 alone, the FTC logged more than $12.5 billion in consumer fraud losses, with a significant portion attributed to payment scams. Check fraud remains one of the largest categories. High-resolution printers, stolen account data, and convincing email […]