The establishment of the Clearing for the 21st Century Act, widely known as the Check 21 Act, has, as we previously noted, introduced a variety of conveniences in America’s everyday money movement. The process of mutual check clearing among banking institutions has started relying significantly on electronic, as opposed to standard, physical check copies. However, this method was not only effective for day-to-day, person-to-person check clearing; through the Check 21 Act, remote depositing also became possible.

What is Remote Deposit Capture?

Remote Deposit Capture (RDC) essentially clears payments by snapping check images rather than sending physical check copies to their intended destination. The overall result is quicker, bypasses potential mistakes, and does a great deal for the environment, as it minimizes cellulose paper usage and thus cuts down on entire forests.

Remote Deposit Capturing: RDC History

Businesses and companies were the pioneers in remote depositing. As these use massive check amounts, it is very convenient for them to remotely deposit funds intended for business expansion, employee payrolls, and overall operational purposes, including transferring money.

However, it is common for individuals to utilize these conveniences as well – especially the busy ones; it is no longer necessary to visit the bank every day, as you can remotely deposit money from the comfort of your home office.

Initially, large companies mostly leaned towards generating remote deposits because, at the time, it was not common to own an expensive piece of technology, such as a specific check scanner. The time frame we are referring to is from 2004 to 2008, encompassing the introduction of the Check 21 Act to the widespread availability of these scanners.

At the time, a standard fee for these services was typically up to $70; between 2005 and 2009, it became common practice for banking institutions to offer clients a free scanner by signing a 1- to 2-year contract. It is worth mentioning that these services were, at the time, still too cost-inefficient for home businesses, until several years later.

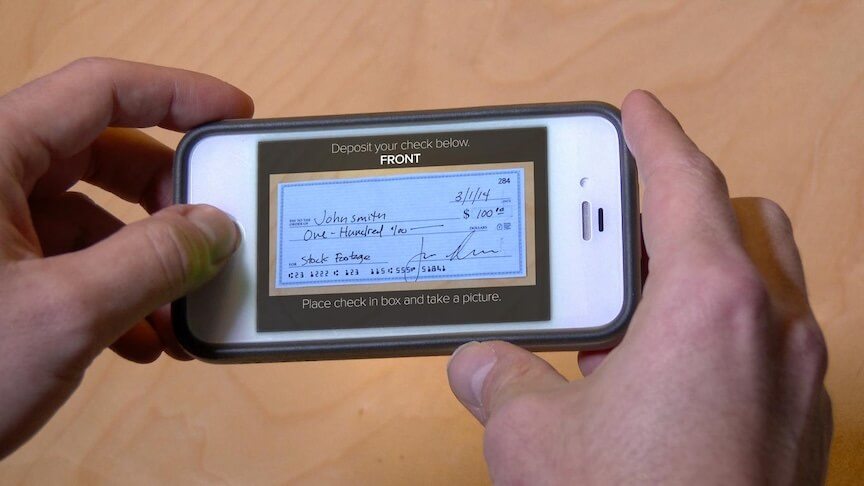

By the end of the first decade of the century, cheaper RDC services had become much more common, utilizing standard scanning devices that are still in use today. This practice brought remote depositing to everyday use within the small-business, home-office-based community, reaching its full potential in the banking world. Today, we use cellphone apps and smartphone cameras for quick image capturing, largely eliminating the need for personal computers, scanners, and other devices.

Financial institutions and third-party money-moving services are very invested in these services. As depositing is quicker and more convenient, it makes everyone’s life much easier. Additionally, the amount of labor required by banks to invest in these services is minimal compared to the labor needed for standard check handling. Customers’ one job is to snap an image – no need for tellers or trips to the bank.

Remote Deposit Capture is, without a doubt, constantly evolving, and it has been since its introduction in America’s everyday economy back in 2004. As it overcame the hardships of expensive technology required for its pursuit, it is now more accessible and widely used than ever before. Today, we use our smartphones to extend funds to places that would have been much harder and slower to reach otherwise – and from the very comfort of our own homes.

Check printing and mailing are our main services; we explore these and many other topics on our blog. Feel free to check it out or learn how to contact us to request an audit.

Last updated: September 2025